What we all want: More Tin!

Let's dive a bit deeper into everyone's favorite metal and figure out whereof it more is about to come online.

As outlined in my previous article, tin is crucial for any electronic product and is the most impacted metal when it comes to batteries and EV. Now, with EV sales crashing currently, that might not be the biggest demand driver, an increasing wealth in the developing world, however, is. Electrification will continue, and the semiconductor cycle looks also favourable currently as well. On the supply side, many problems in Indonesia and Myanmar, decreasing ore grades and dwindling reserves globally add nicely to the bull case for our favourite metal.

In this article, I will present one lesser known tin producer and the two most advanced development projects.

To start, there are only two primary tin producers in which you can invest in. Alphamin (AFM) and MetalsX (MLX). Alphamin is owner of the Bisie mine in the DRC with an outstanding grade of 4,5% Sn and MetalsX forms the 50-50 Bluestone Mines Joint Venture with Yunnan Tin (China), mining the Renison Bell deposit in Tasmania, Australia.

A third company I want to add here is Andrada Mining (formerly Afritin), that in 2019 brought the Uis mine in Namibia back into production and is currently ramping up tin, tantalum and lithium production. I want to focus this article on that company, since I find it to be a lesser-known company that deserves some attention. But to be honest: If you want to play tin with only AFM and maybe MLX, you’re good. Like with other commodities, it is highly recommendable to start getting exposure with the producers. Therefore, both companies should form the base of your tin portfolio. Alphamin also pays a nice dividend (current yield 5,2%) and is currently about to ramp up production at Mpama South.

Besides these three producers, there are no publicly traded companies on western exchanges that mine tin. The number of developers is in the single digits and well, as are companies mainly exploring for tin.

Sector Overview

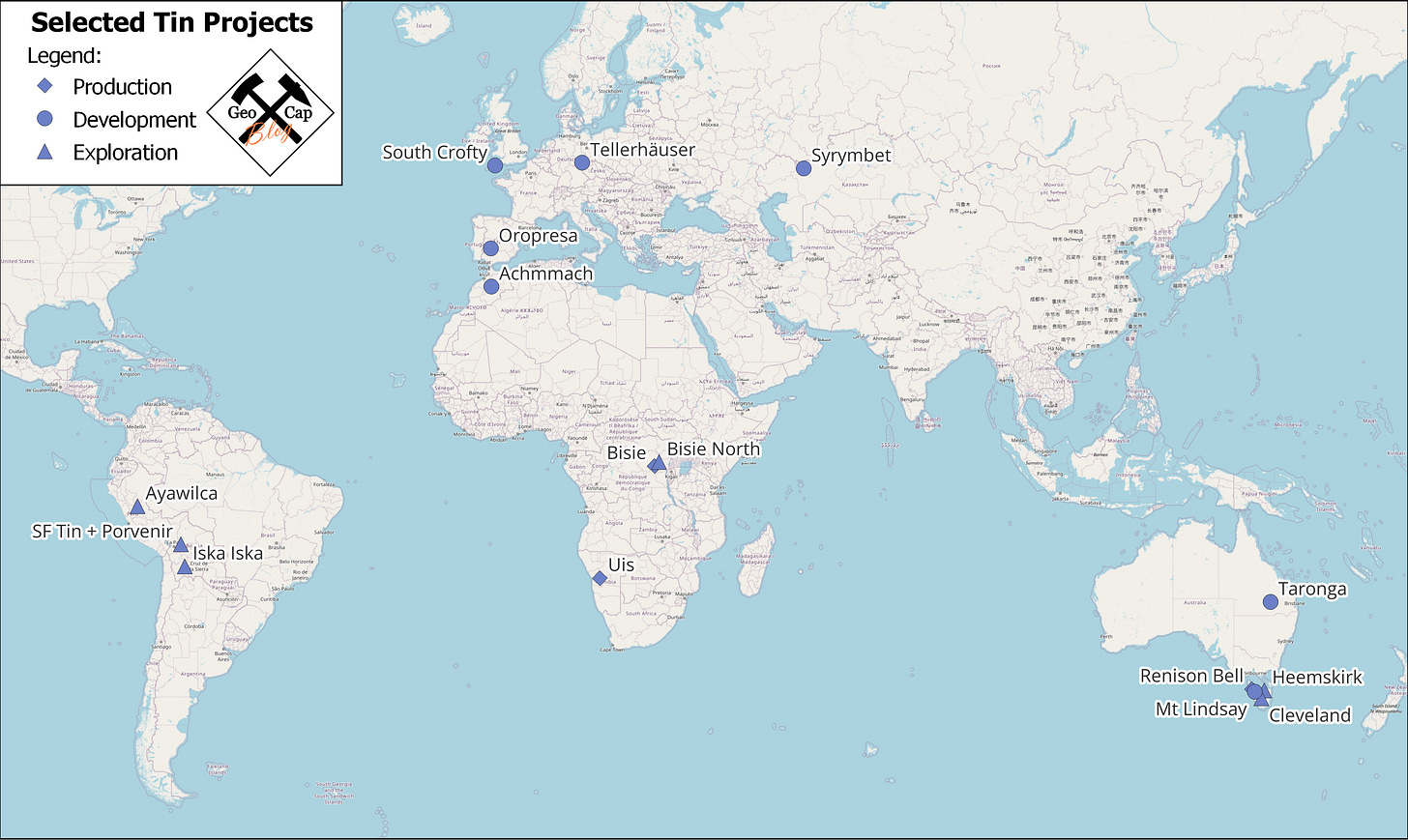

In order to combat the coming shortage of tin, new production needs to come online. China, Indonesia, Myanmar and Peru - as the largest producers - all struggle to find additional reserves. It needs to come from other places. And interestingly, the Western World doesn’t look that bad when it comes to the potential deposits that could host a mine in the near/mid-term future: Starting in the UK, Cornish Metals is currently developing the South Crofty mine. In Germany, First Tin is developing the Tellerhäuser project and in Spain, Elementos keeps advancing the Oropresa project. Elementos is also owner of the Cleveland deposit in Tasmania. On this stanniferous island, Stellar Resources is advancing its Heemskirk project and so is Venture Minerals with Mt Lindsay. Further north in Australia, First Tin again owns the Taronga deposit, currently the development project with the largest (albeit low-grade) resource at the most advanced state. Adding the current geopolitical situation into the equation, these projects are located greatly to supply tin for the Western World in case something should go very wrong, or the deglobalization trend continues, and we see a revival of bloc economics like in the past century, which I find more and more likely. From an ESG point of view (I hate this stuff, but still, it matters to many investors), tin from Western countries is of course much more attractive compared to tin from the DRC.

Atlantic Tin (Achmmach, Morocco, not publicly traded) is development-ready but seemingly struggles to find an investor, and JSC Tin One in Kazakhstan (Syrymbet deposit, also private) published a feasibility study in early 2020, and since then, nothing happened. I’ve heard that they (Syrymbet) have some issues with processing, a well-known enemy in tin mining. Bolivia is a tin miner as well, but I have my issues investing in that country since political instability there is quite a thing there. But it is definetly an interesting country. Eloro Resources drilled out a nice resource recently at its Iska-Iska project, and Tincorp Metals exploring some projects there, too. The country has exceptional potential for silver-tin porphyries, but exploration is limited for a reason. See Bolivia’s failed lithium story, quite an achievement.

The mentioned projects are shown in this map for a general overview. Tasmania is a bit crowded.

In the following, I’ll give an overview about a few interesting projects.

First Tin - really the first?

I think they are making good progress at Taronga. It is fairly a large but low-grade (133 Mt at 0,10% Sn) deposit. However, processing is easy and thanks to ore sorting, the head grade can be increased to 0,15% Sn while the operating costs can be reduced this way. That is very helpful, and a new technique also used by Andrada and other developers. The recovery is pretty good for such low-grade ore at ~65%, thanks to the coarse cassiterite. The deposit is rather big, and comes with a lot of exploration potential in the surroundings. I think it might be the next deposit that comes online.

Just when finishing this article, the DFS for Taronga was published. To summarize it quickly, it looks okay, not bad, but also not overwhelming. Not surprising to anyone, Taronga will not be the Australian Bisie. It will produce 3,600 t Sn in concentrate at AISC of 15,800 USD (24,000 A$) for a mine life of 10 years. Economics looks as follows:

The base case of the DFS is very conservative. My explanation is simply that this is a result from the depressed tin prices until very recently. If you invest in tin (or want to finance a tin mine), do you really expect tin price will be sub 30k? Nope. Hence, a post tax IRR of 34% at current prices looks okay. What remains on the to-do list is a lot of permitting. So there is still some work to do.

With regards to their German Tellerhäuser project (resource: 28 Mt at 0.5% Sn = 138,000 t Sn), I probably know more than I am allowed to write here. To keep it short and legally safe for me: Processing is challenging (polymetallic skarn) and since it is an underground deposit, they need higher tin prices to make this economic. Especially Dreiberg, the deeper (~800 m below surface) part of the deposit, is expensive to access through a decline of several kilometres length. It is a high-cost project. The shallower part of the deposit (Hämmerlein) is accessible through the galleries of the former uranium mine there. The tin was discovered coincidentally in the 1960s, and some galleries in the skarn were developed to mine test material for processing in the 70s and 80s. However, the complicated thing is that the old Uranium mine doesn’t belong to First Tin, but to Wismut GmbH, the successor of the Soviet-East German uranium miner. Is this is a problem or a benefit? We will see.

When it comes to the location, it is a historic tin region - that is worth an extra article since I am very familiar with this beautiful part of Germany. Tin mining dates back to at least the early medieval, if not the Bronze Age. But, it is also in a historic lots-of-bureaucracy region. Similar to the struggle of Zinnwald Lithium, it is hard to get a licence due to many environmental and political issues and some locals causing (somewhat understandable) problems as well, especially when it comes to things like traffic and the impact on tourism and the landscape. Is that manageable? Yes. How fast and at what price? Uff…

So far, Germany - and especially Saxony as the exploration hot spot - have to prove that it can permit a mine under reasonable conditions and at a reasonable timeframe. As someone who’s been involved in these things exactly there, I have my doubts about the “reasonable” part of this equation. On a political level, the EU, the federal government and the local government want mining. But in a practical manner, things look different and nice words aren’t helpful. In the Congo, you can at least bribe people. In Germany, you have to be nice and are at their mercy, no matter what. Choose what you like more.

In the region - called the Erzgebirge/Ore Mountains - First Tin holds a large land package named Auersberg. A drilling campaign focused on medieval mining structures in 2022 did not deliver promising results (quite surprisingly I think) and their Gottesberg licence hosts a resource of 6,8 Mt at 0,49% Sn but is not currently under development or further exploration since the company focusses on Tellerhäuser. The location is difficult since it is close to a drinking water reservoir. Processing however, looks good and there is exploration potential around the resource.

Am I a buyer? Well… I think their German Tellerhäuser project is difficult, both from a technical and permitting point of view. But I like Taronga. And with the DFS now released, and looking okay, I might open a small position.

…and maybe, some German bureaucrats get their butt kicked, and we see a revival of Saxon tin mining. But I’m sceptical at the moment and would also like to see some definitive numbers in the Tellerhäuser DFS. If nearby Zinnwald (owned by Zinnwald PLC) gets a permit, that will be good for Tellerhäuser, so I’ll keep an eye on them, too, since they are a little further ahead than First Tin. It’s the same authority issuing the permits, after all. Also, in Saxony there are elections in September. The SPD economy minister is pro-mining, the CDU prime minister (actually a decent guy, but he needs to do what Berlin says) is, too. but the Green environmental minister… oh boy. If that guy looses his post, that will be good news. And the polls look interesting at the moment:

Another thing: If the German/EU bureaucracy should - in a very unlikely scenario - get their overpaid butts to some productive work (not saying they are lazy) and puts more money into domestic production of critical metals (basically subsidising them, like China does), things might change. The EU wants to produce its own critical metals, but these are only the above-mentioned nice words until now.

I could go on here, but I will likely dedicate an extra article to the mining situation in Saxony/Germany/EU at some point.

Now to projects I am less familiar with:

Andrada Mining - Tin Safari without rebels

Andrada Mining’s (AIM: ATM, OTCQB: ATMTF. Market cap: 77 million GBP/100 million USD) operations are located in Namibia, the former German colony known as German Southwest Africa (Deutsch-Südwestafrika). German colonisation started in 1884 and Südwest was the only colony where a noticable immigration of Germans occured, about 1-2% of Namibia’s population are Germans - a whopping ~20,000 people. Soon, prospectors found deposits of copper (Tsumeb) and diamonds (Sperrgebiet near Lüderitz). And tin? Sure, they found tin!

In 1911, the Uis pegmatites were discovered. Since WW1 started only 3 years later, which resulted with an early defeat of the German Schutztruppe in 1915, mining only started in 1923, under South-African supervision. In the 1980s, Uis was the largest hard-rock tin mine in the world. However, the mine closed in 1990 due to low tin prices, just like many other mines at these times, ask the Cornish or East Germans.

Andrada (formerly known as Afritin Mining) reactivated this historic project and started mining in 2019. They started to produce tin only in the beginning but since then, they added a tantalum and lithium circuit in order to produce a marketable concentrate of those metals as well, but this processing currently is only beginning.

Let’s look into their recent numbers:

Tin-in-concentrate production is up 51% to 885 t, compared to 587 t in the previous year. The amount of ore processed increased by 60% to 915,000 t. The tin recovery stands now at a solid 69% and reached 72% in the last quarter (Q4FY2024). The AISC is at 26,200 USD/t. That is much higher than MLX and AFM, but provides a leverage to higher tin prices. With future selling of lithium and tantalum concentrate, that number should fall as well.

The mineral resource stands at 81 Mt grading 0,15% Sn, 0,73% Li2O and 86 ppm Ta, resulting in 120 kt contained tin. The lithium does come in the form of spodumen and petalite, so selling it both to the ceramics industry and battery manufacturers is possible (petalite is not really suitable for battery-grade lithium). This resource, however, only comprises the V1 and V2 pegmatite bodies directly in the old, now reactivated mine. Within a radius of 5 km around the processing plant, 180 mineralized pegmatites bodies have been mapped. The aim of the companies is to reach a resource of 200 Mt and I think the geological potential allows for that number, maybe even more. Uis is located in a series of pegmatites known as the Northern Tin Belt in the Damara Orogen in Central Namibia and the famous Brandberg massif is also close by, hosting some Sn-W-F deposits as well.

In the neighbourhood, Askari Metals is exploring for lithium pegmatites and I think Nambia Critical Metals also has some projects there. Andrada also encountered Spodumen-rich pegmatites (Lithium Ridge/former Nainais mine and Spodumen Hill prospects), suitable for the production of a battery-grade lithium concentrate, including a tin and tantalum by-product. So, both on a brownfield and a regional scale, there is much upside for tin, tantalum and lithium. Since the pegmatites have a very comparable geology, the existing processing plant could be fed with ore from there.

Hence, I think the company is situated very well to profit from higher tin prices with a large resource and tantalum and lithium upside. Especially the combination of tin and lithium is very interesting to me. As I am witnessing it here in Western Australia, the lithium market at the moment is pretty much dead, therefore I think most lithium-only projects will have a hard time, unless they are Tier 1. A deposit that produces lithium as a by-product, however, has entirely different economics and can make a nice extra income at lower lithium prices. Currently, the company has a cash balance of about 22 million USD and made a loss of around 10 million USD (7.75 GBP) last year. No wonder at these low prices.

As a company that already produces tin, tantalum and lithium, the highest risk phase is over and with tin having already bottomed and lithium also being fairly (perhaps reasonably?) low-priced, I see much upside for the company with limited risk. They are improving their operation, ramping up production, so things are going in the right direction. I like Namibia as a jurisdiction as well. Best place in Africa, I think. A few years ago, I almost landed a job there. I’m looking into buying a small position soon, with the share price now at relatively low levels between 4 and 5 GBp. Is it as hot as AFM or MLX? No. But I like to diversify.

Elementos - Tin flamenco in Andalucía

Another fairly advanced project in a lesser known jurisdiction is Oropesa in Andalusia, southern Spain, owned by Elementos Resources (ASX: ELT). While the Spanish there is very strange, mining is much easier. The region’s mining history dates back to ancient times, 5000 years minimum. The Río Tinto deposit (named after the blood-red river there) was mined already by the Romans, and so were some other gold and copper deposits in the area. Next to Río Tinto, the former Corta Atalaya mine is the largest open pit in Europe. Mining is still an important part of the Andalucian economy. Río Tinto is still operating and other mines like Cobre Las Cruces by First Quantum add to the mining landscape, just to name one example. Adding a tin mine would give the region extra flavour (completely neutral opinion here) and working with the authorities seems to be less problematic and more straight-forward as in Germany. So as a jurisdiction, Spain/Andalusia is doing quite well.

Oropesa is a near-surface deposit which was discovered in the early 1980s by the Spanish Geological Service, and some exploration activity took place after the initial discovery. Elementos acquired the project in the early 2018 and advanced the project to a DFS study that is about to be finished this year with most key parameters already being established:

18,5 Mt resources (M+I) at 0,38% Sn, containing 72,000 t Sn

mine life of 12.5 years

finished metallurgical test work (74% recovery - nice)

ongoing negotiations with local mining authorities regarding the mine plan. DFS is halted until that is finished

Oropesa is a flat-lying carbonate-replacement/skarn deposits and comes with a zinc by-product (copper is also present). For a CRD/skarn deposit, the metallurgical recovery is fairly good. This is a great plus. Since the deposit occurs in deformed sediments and some faulting played a role here as well, the geometry is rather complex and there is no granite directly underlying the deposit. While company drilled some step-out holes and found mineralization outside the mineral resource, The current MRE models the resource down to 200 m below surface and that makes a good open pit. The lower limit of the resource is a fault that liking functioned as a fuid pathway for the mineralization.

This is a fairly advanced project that has a good chance to come into production within the coming years. However, what I missed (I may just haven’t found it) is a number for the production costs for Oropesa. Looks like we have to wait for a final number until the DFS is published. But with the high recovery and the - compared to Taronga - high grade, I have a feeling that this could be a fairly low-cost deposit. If Taronga at 0,1% Sn in Australia (high costs) can produce tin for ~16,000 USD/t at say 60-65% recovery, Oropesa in Spain (low cost compared to Australia) with 0,38% Sn and 74% recovery should be much cheaper, right?

Simple calculation:

1 t ore at Taronga: 0,1% in the deposit, 0,15% after ore sorting. 65% recovery = 0,975 kg Sn per ton processed.

1 t ore at Oropresa: 0,38% in the deposit, ore sorting resulting not published yet. So, 74% recovery = 2,812 kg! Almost three times as much. Kind of obvious if the grade is 3x, but it highlights the economics. At similar costs (assumed by me for the sake of argument), guess what that means for the AISC. That makes the project fascinating. On the other side, it is much smaller as Taronga, and that likely raises production costs. We’ll see in the DFS.

At Cleveland, Tasmania, the company is about to start drilling now (early May). They intend to drill a 1,100 m diamond drill hole to check deep tungsten-tin-copper mineralizations under the former mine. The Cleveland project currently comes with a resource of 6.23 Mt at 0.75% Sn and 0.30% Cu. There are also tailings from the former mine that comprises a 3.70 Mt resource with 0,29% Sn and 0,13% Cu. The tungsten component is ~4 Mt at 0,28% WO3. All in all, it is an interesting exploration project with a polymetallic character. The copper story is well known and in times of increasing ‘geopolitical challenges’ (that is, more things get blown up using tungsten), tungsten has its use as well. Let’s see what their drill hole says.

Even though it is a shorter presentation of the company, I have a good impression. I like the Oropresa projects and do not see red flags there and my feeling is that either Oropresa or Taronga will be the next tin mine. They carry out some regional exploration at both projects, so there is upside potential here, too. Both regions are very interesting for tin exploration. The stock rallied quite a bit in the recent weeks, like of tin stocks, but is still cheap at a market cap of ~20 million USD/35 million A$ at 0,18 A$/share. Waiting for some news from Spain would lower risk here.

Outro

There are certainly more tin projects worth talking about. One that comes to mind is South Crofty by Cornish Metals or Heemskirk by Stellar Resources. But I want to keep this article at a reasonable length and update you at a later point in time on these (and maybe other) projects. You need a reason to stay subscribed, right? ;-)

Future outlook: I am currently working on a non-commodity article explaining why East Germany (my home country) is different from West Germany. This will be the first part of a three-part series about Germany and its current challenges (=Greens and other socialists f*cking it up… again!) and its future. Something different here on my substack.

I am also planning to write an article about the Argentine copper story. In preparation for that, I highly recommend you read

. He has some great articles on that topic with boots on the ground. I will present a more strategic overview.

You made it. Grab yourself a beer, you earned it.

Thank you for reading!

Great article & thanks for the shout out mate. 🤝