Argentina's Commodities - An Overview

Bringing some light into the Argentine resource sector. #commodities #argentina #gold #silver #copper #oil #natgas #uranium #nuclear #milei

Short update on Milei

General Country overview

Agriculture

Gold & Silver

Copper

Lithium

Oil & Gas

Uranium and Nuclear Industry

Renewables

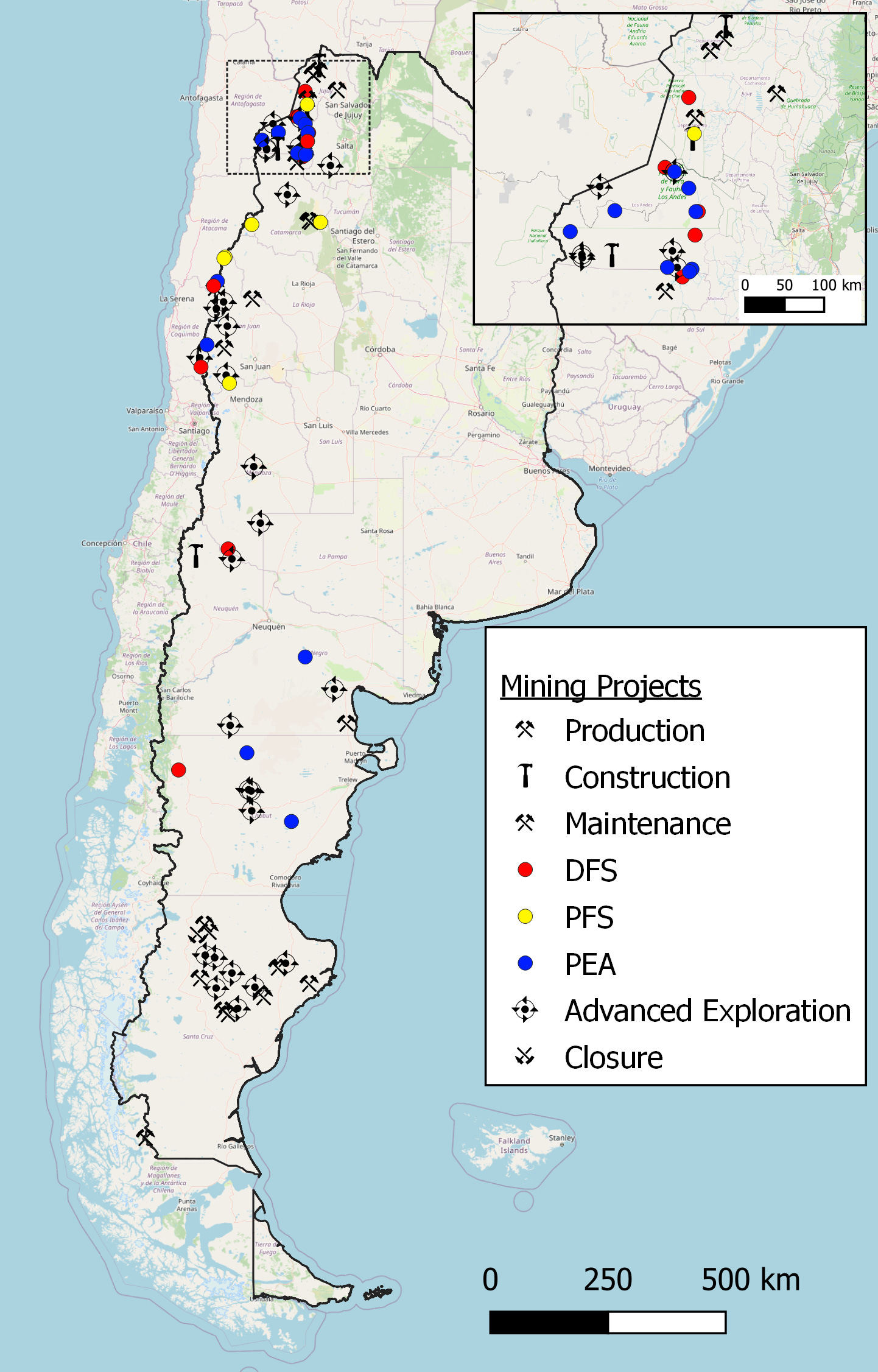

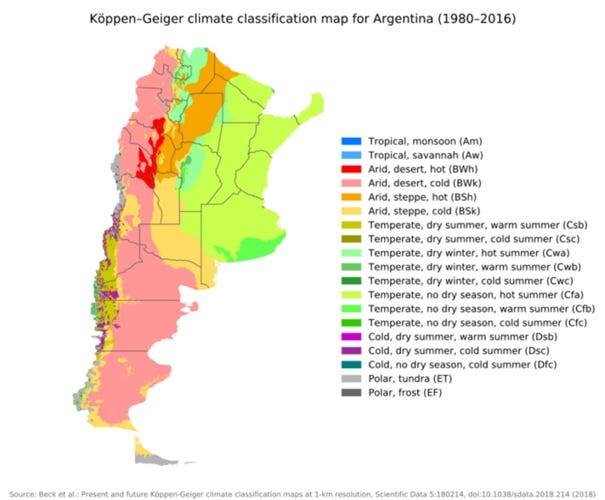

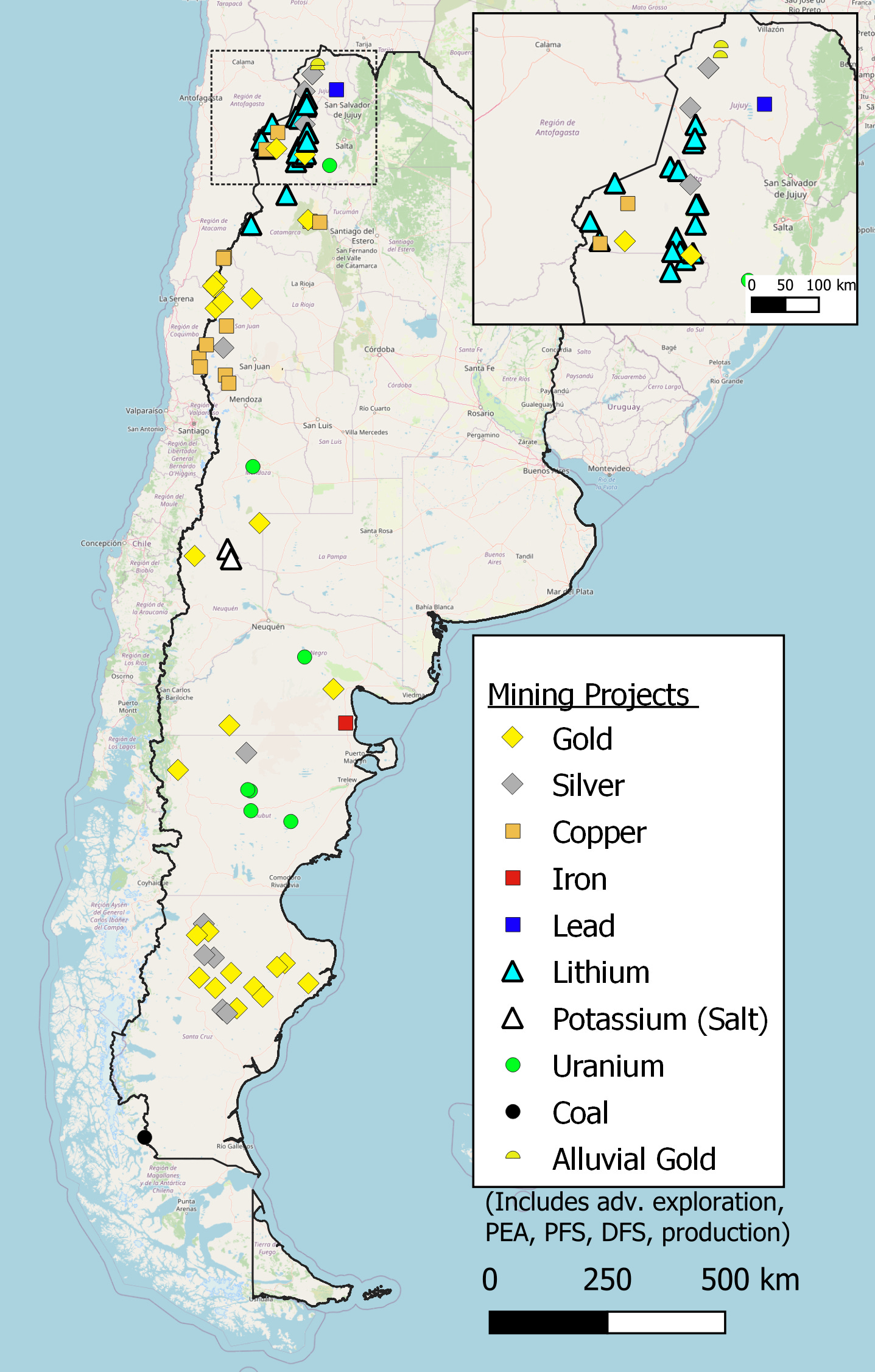

As indicated in my previous post, I will give you an overview about Argentina’s mineral and to lesser degree agricultural and industrial potential. I am a geologist by trade, so naturally I stick to what I understand best. I prepared some maps to give you an idea where what is.

1 Milei Update

Before that, I want to talk quickly about Milei again: Now the data is out, in his first month in office his new government cut expenditures by a whopping 30%. Without going further into detail here, I think that shows that he is serious. During his recent speech at Davos, the opening words of our beloved Klaus showed pretty clearly to me that he despises “the … freely… elected” Milei. His speech itself was good, gained a lot of attention worldwide, so that was great publicity. His proposed reforms are met with opposition and challenges domestically, that was to be expected. Relations with China are a thing, we will see how this works out. I like that the Chinese put some pressure on him. On January 24th, there will be a general strike.

In street interviews, you get the general impression that the people know that the change will hurt in the short term, but they find it necessary. For example, when the subsidies for public transport were cancelled and prices were expected to rise quite dramatically (from a very low basis though), some journalists from the public media tried to find people in the Buenos Aires rush hour to say that they don’t like it. Workers for socialism, so to speak. In the end, they had a hard time finding them. Most of the people that actually work said that they can not only afford higher prices, but they also find it unjust that other people pay for their ticket. With the 50% devaluation of the Peso in December, grocery prices rose dramatically (70% in some cases). And that really sucks. But most people seem to understand that the almost 250% discrepancy between the official and unofficial rate had to end at some point. So I stay optimistic. This is a long-term process here.

Let’s talk commodities.

2 A brief introduction of the country

Argentina is the 8th largest country on the planet and covers an area of 2.7 million km². The population is steadily growing and reached 47 million recently. About 80% of the people have European ancestry and interestingly, the birth rate is still at 2.3 children/woman, which means the country has a future (demographics are underrated to evaluate a country’s future in my opinion).

The population density in theory is 14.4 people/km². But since a third of the Argentines live in Buenos Aires alone, the country is basically empty. Especially for a European like me. A North American or Australian reader might see that differently. In terms of mining, this is good. The fewer neighbours, the better.

In map 1 you can see the climate zones of the country. The lush green here represents the fertile Pampa, a major producer of beef, soy, grain, maize, sunflower. It is a very flat area with a friendly and humid subtropical climate. Further south, entering Patagonia, is gets dryer and colder – and windier. The reason for this increasing dryness is that the Southern Andes are not high enough to shield Patagonia from the west wind drift coming from the Pacific Ocean. Hence, all the moist air precipitates in the mountains and leaves nothing for the other side. The Patagonian Desert is mountainous and is home to the Deseado Massiv, a gold-silver province, the San Jorge, Austral and Neuquén basins are the major oil and gas producers in the country.

The Patagonian Andes themselves are usually covered in forests. It is a gorgeous area with rainforests on the Chilean side and a very Alpine-like climate in Argentina. Nice in summer for hiking and swimming, great in winter for skying. Many beautiful, crystal-clear lakes.

Further north, the Andes become dryer. Nevertheless, the soil is fertile, and the first Spanish settlers noticed that early on. They built irrigation systems and planted wine, making Mendoza a producer of world-class red wines which are perfect in combination with a steak. North of Mendoza, the Puna rises. This is a high plateau in the Andes. It hosts the famous Salars – the lithium salt lakes. But just like on the Chilean side, there are also many copper porphyries and their associated gold-silver hydrothermal systems.

In the northeast, the two large rivers Paraná and Uruguay are the most prominent features of that fertile area.

In summary, the agricultural heart of the country lies in the central and northeastern part, including the provinces of Buenos Aires, Córdoba, Santa Fe, Entre Ríos, Corrientes, and Misiones. The lion share of the mineral potential is located in Patagonia (gold, silver, oil & gas) and the northwest (copper, gold, silver, lithium).

3 Agriculture

The agricultural sector struggled not only because of a severe drought recently, but mostly from the currency and tax regime. The Argentine agricultural exporters face an export tax, which provides the government with a lot of income. Quite surprisingly, in a decree from late December, export taxes were raised. The other major problem was the peso exchange rate. I noted in my previous article how difficult this topic is. Most importantly, there is the official rate, the dolár blanco (now ~800 ARS/USD) and the unofficial dolár blue (~1200). Milei devalued the Peso in December from a bit less than 400 ARS to 800 ARS. This certainly hurt the Argentine saver and consumer, but it was necessary to give the Peso a value that at least comes close to reality.

Back to agriculture. Besides blanco and blue, there are fixed prices/exchange rates for agricultural goods. This meant that a local farmer sold his, i.e. wheat for the artificially low local price (+ taxes) at the local stock exchange and the government sold the same goods later on the international market at real prices in dollars. This is not helpful for encouraging production and exports. Giving farmers real prices would help a lot. The same goes for miners exporting their concentrates. That might explain the currently low valuation for the local miners, especially in Patagonia.

On the other hand, imports needed to be manually accepted by the Central Bank. Example: You need some spare parts for your truck from overseas. Payment is in dollars. You apply for the purchase of USD at the Central Bank and they decide. Not you. This takes time, is annoying and really puts friction into the system. Milei now cancelled this procedure, but still, it is rather complicated. The problem is that if one would completely deregulate the FX market, the country would likely run off out USD within hours.

The above means that the capacity currently in place, both in mining and farming, cannot work efficiently because of the fiscal regime that was in place and now is gradually improving. Hence, without much investment being needed, one can expect improvements in the profitability of local companies. Other factors like increasing energy prices after the cancellation of subsidies may offset this a bit but, nevertheless, we are coming out of the bottom here so I assume it can’t get much worse for the companies. And still, the Argentine agricultural sector produces food for 440 million people, ten times the domestic population. Since agricultural goods are the responsible for most of the export revenues of the country, a productive farming sector is significant to get tax income up, budget deficit down and bring more dollars into the country.

4 Metals & Mining

Let’s come to the core of this article, the ‘underground’ situation in the country. Argentina posses significant deposits of gold, silver, copper, lithium, oil, gas, uranium, molybdenum, lead & zinc. Some iron deposits gained attention domestically in recent times, and there is one operating coal mine. But this mine (Río Turbio in southernmost Santa Cruz/Patagonia, really remote) is dependent on subsidies, and we can imagine how that ends. The mine operates since 1945 and supplies some domestic power plants.

When talking about mining in Argentina, it is important to keep in mind that the country is a federation, so the federal states decide about mining laws. This is why Salta, Santa Cruz and San Juan are usually among the top mining jurisdiction in the Americas, whereas La Rioja and Chubut (directly bordering top jurisdictions) are not. Recently, Mendoza opened up for exploration and mining a bit, so keeping an eye on the provincial developments might be to your benefit.

4.1 Gold & Silver

One of the mayor mining areas in the country is the Deseado Massif in Santa Cruz province (Patagonia), where several gold-silver mines are operating, and many exploration and development projects exist. The deposit type mined here are low- to intermediate sulphidation veins. Both open pit and underground mining takes place. The largest and oldest mine there is Cerro Vanguardia, operated by AngloGold Ashanti with an annual production of 1.7 koz Au and 3.7 Moz Ag in 2022. This province is about 60,000 km² large and has a huge exploration potential. Many projects have been known for quite some years now and not much happened due to the general bear market in the last decade and the capital controls of the government. Some fresh capital could get many things going there.

Outside the Deseado Massif, there are several projects in the northern part of Patagonia, in the Somún Curá Massif (also called North Patagonian Massif). It is geologically speaking the same thing as the Deseado, it is just separated by the San Jorge basin (oil & gas) and located mostly innmining-friendly Río Negro, but its southern part is in Chubut. There is currently only one mine, but a few more exploration projects. The area is less busy than the Deseado, but potential certainly exists. I think it got shadowed a bit by the Deseado.

Quick sidenote: Chubut Province is a special case. Long story short, they don’t like mining. The Andean town of Esquel is the anti-mining capital of the country, they successfully cancelled a gold project in their neighbourhood in 2002. It is a beautiful area and my next holiday destination for the late summer, so I get that. What I don’t get in the general ban on open pit mining. The reason for this is, officially, dust emissions. In a fucking windy, dusty desert. This affects Navidad (Pan American Silver), the world's largest undeveloped silver deposit. Mining that big boy could make the almost bankrupt province debt free in a few years, but no. Recently, the governor got the massage and tried to lift the ban on open pit mining. The results were riots in the streets and a cancellation of his plans. Currently, the province needs direct financial aid from Buenos Aires. Maybe Milei tells them to bring their house in order, and they can sit down and think again. If Chubut changes its mining laws, this but be a huge thing.

Fun fact: Nobody cares about the oil fields in the province. Oil is fine, mining is evil.

4.2 Copper

During the last couple of years, it became more and more obvious that the massive copper endowment of the Chilean Cordillera doesn’t stop right at the border. The recent success of companies like, among others, Filo or NGEX proves the massive potential in the Argentine part of the Central Andes and I think it is safe to say that these two companies will not be the last ones finding something big there. If you consider that Chile attracted exploration companies for several decades now and mining is going on there for over a century, and there is still some potential left to find blind, perhaps smaller and lower grade deposits, one can imagine the truly massive potential of the Argentine side. It is true that the border favours Chile, and Argentina certainly will not be the largest copper producer in the future. But I find it highly likely that some of the next major copper discoveries and a significant share of new copper mines will be in Argentina. At best, this will happen in a time when the copper market is in a deficit and prices are high. This could be very exciting.

Especially interesting here is the Vicuña District in San Juan province, close to the Chilean border. For example, the Lundin family is quite active there and the potential, as said above, is quite intriguing. Note that most projects that are currently under exploration or development are not really recent discoveries, but rather some old project that never got the right attention. That means that there is a lot of potential for green field discoveries away from known deposits and, of course, having a closer look around known mineralizations is also quite worth it. Historically, Argentina has not really attracted much capital for exploration. It basically started all in the 90s under President Menem, so there is just not much work done on these vast territories. The ship has not left the harbour yet, the party is just getting started.

Also, quite encouraging are recent developments in Mendoza province: Until very recently, mining and exploration was practically banned due to worries about water quality. Mendoza produces truly great wines and even as a geo, I fully understand their reservations. But since the province is quite big, they now have a more nuanced approach: Exploration and mining is okay if it doesn’t affect the water situation. This opens a new province just south of San Juan for exploration and the Andes here hosts some known gold-silver mineralization. Another blank spot on the map that is about to get some painting?

To the north of San Juan, especially in the very mining friendly Salta province and Catamarca as well as Jujuy, the story continues with lesser intensity. The further north we get, the more lithium projects we get. That brings us to the next commodity.

4.3 Lithium

Argentina has currently the 4th largest lithium reserves and is the 4rd largest producer. The sector is booming and the fastest growing globally. There are three mines operating, about 40 further projects are under exploration and development with half of them being able to reach production within the coming years. The Chinese are heavily involved in that sector, recently they also built are battery plant in I think Salta as part of the belt and road initiative. That demonstrates China’s willingness to add some local value-creation to the story, which I like.

In 2022, lithium export grew by 235% to 1.6 billion USD, almost half of total mining exports. For 2023, an export volume of 4.5 billion USD is expected. Strong numbers. But as a personal note, I think the lithium hype is over in the short term with a lot of supply coming online, and I don’t share the enthusiasm on the fast-growing demand. It will grow, but EV adoption for the most part seems to be the wet dreams of the ‘big thinkers’ as Rick Rule likes to call them. Hence, I only will talk briefly about lithium here.

That is in stark contrast to oil and gas, so let’s have a look at the dirty stuff.

4.4 Oil & Gas

A somewhat similar growth situation might occur in the oil & gas sector. The first oil discovery was made in 1902 in Comodoro Rivadavia, a coastal town in Chubut province, Patagania. For a long time, YPF, the national oil company, produced most of their oil there. The Neuquén province (Northwestern Patagonia) is also a major oil producer in the country. Especially here lies the big potential: Vaca Muerta.

Vaca Muerta is the world’s second-largest shale gas and 4th largest shale oil province. For quite some time now, YPF and foreign companies tried to unlock the potential but due to the general global and domestic situation, things didn’t go as planned. On the technical side, most problems are solved, and the engineers know what to do. They could learn from the American shale drillers and adjust to the local rock properties. What was missing, however, was sufficient financing and infrastructure. While financing stays an issue (not only for the Argentine oil sector), the infrastructure problem is getting increasingly solved: A new pipeline to Chile is currently being finished and another pipeline to Buenos Aires has been completed in July. A second part of that project is about to get started and could provide more gas to Northern Argentina, where dwindling Bolivian imports create some challenges. Overall, the Nestor Kirchner pipelines saves the country around 2.2 billion USD in energy imports, out of a total of 4.5 billion imported in 2022. This is a great step forward and helps the country to save dollar reserves.

Further South, in Tierra del Fuego and Santa Cruz, there is the Austral basin where some offshore operations are taking place and a significant amount of the domestic natural gas production is located. Oil is extracted to a lesser degree. Several global mayors are active here as well and already, offshore exploration off the coast of Tierra del Fuego and Santa Cruz is taking place. A similar exploration activity is currently under way off Buenos Aires province (and Uruguay) and if we consider the oil deposits off Brazil and the recent exploration successes off Namibia and South Africa, I find it very likely that the Argentine coastal waters offer a great potential for future oil and gas production. The geology here is clearly very prospective.

But as it is often the case, the voice against drilling are the loudest where people have no experience with this sort of business. While I expect not much resistance to exploration and exploitation in Tierra del Fuego or Santa Cruz, I read some stories about environmentalists mobilizing against exploration off Mar del Plata, the 5th largest city in the country and a major destination for summer holidays. Let’s see how this develops. The Buenos Aires province is still under the Kirchnerista’s rule and I have the feeling that the governor (Axel Kicillof) will mobilise against foreign oil companies invited by Milei. Kicillof is an integral part of the Kirchnerist/Peronist system and was minister under Cristina Kirchner (economy and later finances). He was involved in the nationalization of YPF in 2012-14.

On another front, there are plans to build another export terminal in Rio Negro province to further increase the potential to export LNG. All of this is needed since in spring 2023, Vaca Muerta achieved a production record and the trend keeps going up. Like many other things, lifting capital controls, attracting foreign investment will be key to bringing these projects forward. And just as a reminder: If one expects that Argentina’s economy will grow, they will need more energy. Energy is the economy. The more oil and gas they produce, the better. Since Milei took office, the petrol prices more than doubled to the cancellation of fixed prices and subsidies. Demand is mostly inelastic as long as the economy doesn’t nose-dive, so the companies now can sell their goods for reasonable prices on the domestic market.

4.5 Nuclear Energy

Nuclear energy is present in Argentina as well. Besides Brazil, Argentina is the only country in Latin America to operate nuclear power plants and its history dates back to the 1950s when an Austrian guy named Ronald Richter built the first reactor near Bariloche. Nothing suspicious here. The city is until today home to the nuclear industry with INVAP, a high-tech company, building reactor parts, radars, and satellite systems there. INVAP is the only Latin American company that supplies parts to NASA. Currently, there are two nuclear power plants in operation, Embalse near Buenos Aires (one block, 600 MW) and Atucha in Córdoba province (two blocks, 1000 MW). A third block is planned for Atucha, but I guess the Chinese involvement there might be problematic in the future. At Embalse, a small modular reactor is under construction.

Argentina had its own uranium supply and many uranium deposits are known. However, presently, imports are needed and about 100 t of uranium is imported annually. There are several uranium explorers active in the country, and the National Nuclear Energy Commission would prefer to buy domestic uranium instead of importing it. And maybe you heard what is going on recently on the uranium spot market and how Kazatomprom faces some serious production challenges. Having a domestic supply, perhaps even exporting uranium, would be useful. In terms of enrichment, at Pilcaniyeu, 60 km east of Bariloche, there is an enrichment facility operating since 2015. A heavy water plant exists in Neuquén and a uranium treatment plant is located in Ezeiza, Buenos Aires. I think that is quite a solid basis for future expansion.

4.6 Renewable Energy

And unlike in my sunny home country called Germany, I find it useful that they are drastically increasing their solar energy output. Especially since most people have an air conditioner, this energy can be used directly. Unlike Germany, where nobody knows what to do with all the excess energy on a hot summer day. There is also much potential for wind and hydropower in Patagonia. If made cleverly, extra water reservoirs can be used as a pumped storage plant. The local geography is generally suitable for this and this way, the energy output could be brought to a constant, reliable level. Again, in comparison to Germany, this fails here because there is simply not enough storage capacity on windy/sunny days and building new pumped storage plats is practically impossible here.

Especially in Patagonia and the southern Buenos Aires province, wind parks get more and more numerous and while I am generally a bit sceptic about renewables, I find they make a lot of sense in this area. This has two reasons: First, Patagonia is very very very windy. To tell a short anecdote, when I was working in Santa Cruz, one day it was so damn windy that the bed of a truck was blown away after it unloaded material. Imagine that. One of our indios commented that with “el viento que hijo de puta”. So wind energy makes sense. The other thing is that most of the electric energy, especially in more rural areas, is produced by either diesel or natural gas generators. I don’t know the technical details, but these should be capable of adjusting their power output depending on wind energy supply, resulting in a stable energy supply. Again, in Germany, that is not really the case, and this is why we have so strong electricity price fluctuations.

I hope you found that information here useful, and you have a better understanding of the country now. I kept it consciously on a strategic level and didn’t mention many projects or companies. I will do so in later articles.

The next article that is already in progress will be about the Deseado Massif. I will explain the local geology a bit, go into detail on some companies there and explain what challenges they are facing. I plan to do the same with the Andean copper story, Argentine uranium, and the oil & gas sector in the future.

Thank you for reading!

Nice one mate. Great write up!

Hey, just wanted to say I found this to be a really interesting read! Thanks for taking the time to write it and I’m looking forward to your future posts